The Sweet Way

to Budget

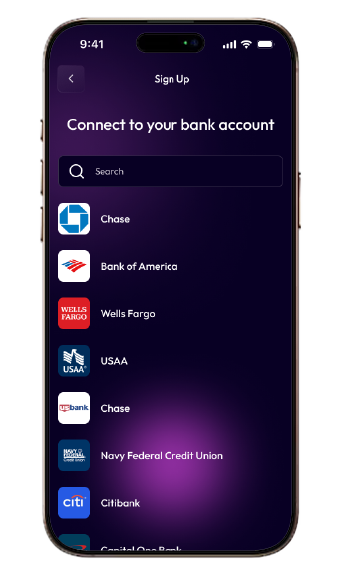

SIMPLE & SECURE SETUP

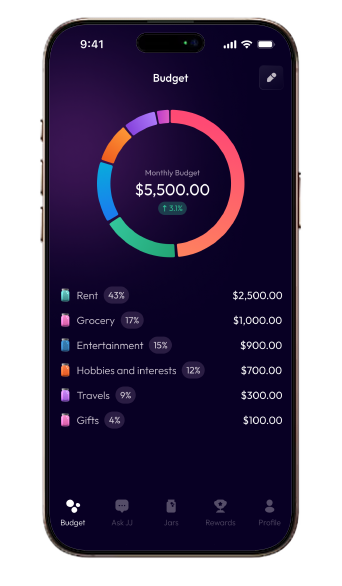

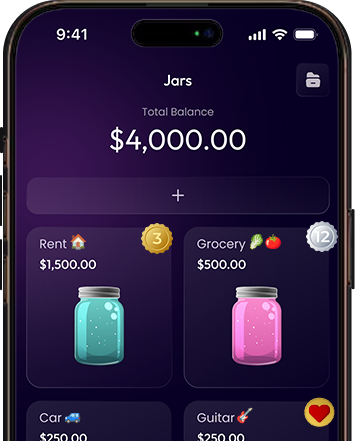

Stay on budget

Organize your money with JelliJARS

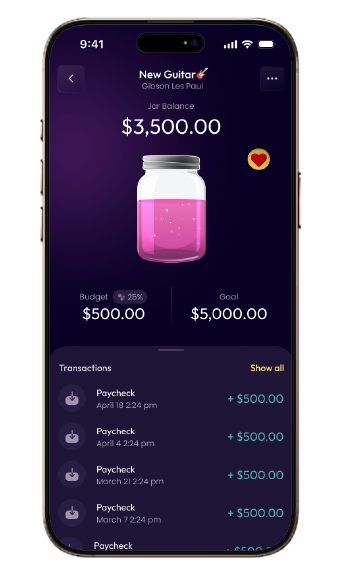

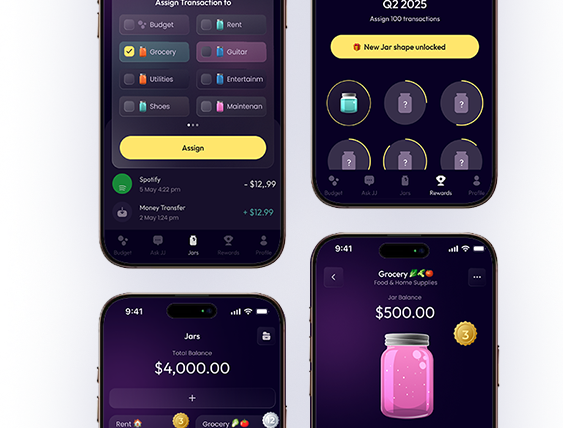

CUSTOMIZE YOUR JARS

AUTO-REFILL JARS

Simple budgeting.

Set up in minutes.

Jelli makes budgeting feel like second nature.

New Car? New Jar. Quick & Easy.

Payday? Pre-Sorted. Zero Stress.

Know where you are. Always.

Three simple steps.

Instant financial freedom.

-

Connect Your BankSecurely link your account in seconds. Jelli syncs your transactions in real-time.

-

Let AI Build Your BudgetOur smart system creates personalized JelliJARS based on how you actually spend.

-

Track, Save & Slay Your GoalsWatch your money organize itself. Assign transactions, set goals, and stay on budget without the hassle.

-

Have Fun!Okay, that's four... JJ makes budgeting a GAME. Earn badges, collect JelliBEANS, upgrade your jars—and level up your life!

Real Experiences,

Real Results

Backed by buzz. How will you

use your #JelliJARS ?

Who should use Jelli?

Anyone who is looking for a simple way to budget. We know budgeting can be difficult and stressful. Jelli makes budgeting easy. Our AI-Powered Budgeting Assistant, JJ, helps you create a baseline budget in minutes. Once your budget and JelliJARS have been created, JJ will allocate your paycheck to your jars each time you get paid. When you make a purchase, JJ lets you know in the app and prompts you to assign the purchase to a jar. The jar balance is debited showing you the new funds amount available for spending. You always know how much you have to spend. It’s that easy.

Can Jelli integrate with other tools?

Jelli integrates directly with your bank account via Plaid. When you sign up, the Jelli App will walk you through the integration process in just a few steps. Once Jelli is connected to your bank account, the Jelli App updates automatically throughout the day so you always know where you stand. And for those who want to do some old-school budgeting with a spreadsheet, you can download your activity any time.

Does Jelli Use AI Technology?

Yes. Jelli’s AI-Powered Budgeting Assistant, JJ, is central to Jelli’s budgeting platform. JJ analyzes your spending in your bank account and prepares a base-line budget from your spending history. From there, you are able to make adjustments and add additional jars that you may need. While JJ automates some budgeting processes, he allows you to have the ultimate control, giving you the power to make any adjustments you see fit. He will make recommendations but the final choice is left up to you, he won’t do things without asking 🙂

How much does Jelli cost?

Jelli offers two options. Our Rookie version is for people with just one bank account, perfect for people starting out, and it’s $2.99 per month. Our Pro version is for people with multiple bank accounts and credit cards and it is $5.99 per month. There are no contracts. You can sign up and cancel at any time.

Is Jelli a bank account?

No, Jelli is not a bank account. It’s a budgeting app that connects to your bank account. When a transaction occurs in your bank account, it will be mirrored in your Jelli Account.

Can I send or move money to a different person or bank account with Jelli?

No. If you want to send money to someone, you have to use a P2P platform like Venmo or Zelle. If you want to move money from your checking to your savings account or to another bank account, you have to use your bank’s mobile app to do so. Jelli only reports on money movements, you can’t initiate any money movements with Jelli.

Will I receive a debit or credit card when I sign up for Jelli?

No. Jelli will not send you a card. Jelli is a budgeting app only. You use your current bank account debit card for making purchases and Jelli will show those purchases in the Jelli App.

Will signing up for Jelli affect my credit?

No, Jelli does not run a credit check when you sign up for an account.

If I had a Jelli Account in the past and canceled it, can I reactivate my account?

Yes, simply sign up again and JJ will help you get started. However, we don’t store your old account data so you will begin fresh.

How can I become a Jelli Affiliate or Brand Enthusiast?

If you would like to become a Jelli Affiliate or Brand Enthusiast to refer Jelli to others, reach out to hello@jelli.us to learn more about our Jelli Affiliate and Brand Enthusiast Programs.